Sell Your Huntsville House Fast

No Repairs, No Fees, No Hassle

Need to sell your house fast in Huntsville? Whether you’re facing foreclosure, dealing with an inherited property, going through a divorce, or you’re just tired of being a landlord—we can help.

Yellowhammer Home Buyers is a local, family-owned company based right here in Huntsville on Rison Ave NE. We’re not a call center in another state. We’re your neighbors—Brandon and David—and we’ve been buying houses in Huntsville and throughout North Alabama since 2021. We specialize in helping Huntsville homeowners who need to sell their house quickly for cash. Whether your property is in Five Points, Jones Valley, Blossomwood, Hampton Cove, or anywhere in the 256 area code, we can make you a fair cash offer and close on your timeline—as fast as 7 days.

Yellowhammer has completed over 200 transactions in North Alabama, and Brandon and David have done over 600 deals combined in their real estate careers. We understand the unique challenges of selling a house in Huntsville. From foundation issues caused by our limestone soil to navigating probate through the Madison County Probate Court, we’ve handled it all. Learn More About Our Company

Why Huntsville Homeowners Choose To Sell To Yellowhammer

We’re not a faceless corporation or out-of-state investor. We’re local Huntsville homeowners and business owners who care about this community.

We’re Licensed Real Estate Professionals

We’re Licensed Real Estate Professionals

We’re not your typical “we buy houses” company. Brandon is a licensed real estate agent and David is a licensed real estate broker. This means we can offer you more options and better insight than unlicensed investors.

More Details

Brandon Hardiman – Licensed Real Estate Agent

- Alabama License: #000170383-1

- Background: 10+ years as an engineer before real estate

- Real estate experience: 5+ years helping Huntsville homeowners

- Brokered by: Elevate RE LLC (000172973-0)

David Barnett – Licensed Real Estate Broker

- Alabama Broker License: #000110591-1

- Background: U.S. Army Veteran

- Real estate experience: Licensed since 2014, 400+ transactions

- Construction specialty: Home renovation management since 2017

- Brokered by: Elevate RE LLC (000172973-0)

Why this matters: Many “we buy houses” companies are unlicensed investors. Our licenses mean we’re:

- Bound by professional ethics standards

- Accountable to the Alabama Real Estate Commission

- Able to offer you MORE options (sell to us, list with us, or hybrid approaches)

- More knowledgeable about contracts, title issues, and processes

Expert Knowledge of the Huntsville Market

Expert Knowledge of the Huntsville Market

We understand Huntsville-specific issues like foundation problems from our limestone bedrock, the specific challenges of homes in historic districts, how to navigate the Madison County Probate Court for inherited properties, and the foreclosure process in Alabama.

More Details

Historic Home Challenges: Many of Huntsville’s most charming neighborhoods (Twickenham, Old Town, Five Points) have homes built before 1960 with unique challenges:

- Knob-and-tube electrical wiring

- Cast iron plumbing (requires complete replacement)

- Outdated electrical panels (60-amp service instead of modern 200-amp)

- No central HVAC (window units only)

- Outdated insulation (or none at all)

We’ve renovated Victorian-era and early-1900s homes and know exactly what these properties need to be brought up to modern standards.

Madison County Probate Process: We’ve handled 30+ probate property sales through Madison County Probate Court. We understand:

- The specific requirements of Madison County Probate judges

- How to work with estate attorneys

- Timeline expectations for probate sales (typically 30-60 days)

- How to handle properties with multiple heirs who disagree

- What documentation is needed

Foreclosure Timeline in Alabama: Alabama is a non-judicial foreclosure state, meaning foreclosures happen quickly without court involvement. If you’re behind on payments in Huntsville:

- You’ll receive a notice that your home will be auctioned

- The auction happens at the Madison County Courthouse (30-45 days after notice)

- Once the auction occurs, it’s too late to stop it

We’ve helped many Huntsville homeowners stop foreclosure by purchasing their home before the auction date and paying off the mortgage. Time is critical.

We’re Actually Local (Not a National Chain)

We’re Actually Local (Not a National Chain)

When you call us, you talk directly to Brandon or David—the actual owners. We’re not a franchise or a lead generation service that sells your information to investors across the country.

More Details

Our Huntsville presence:

- Office: 606 Rison Ave NE, Huntsville, AL 35801 (northeast side, near airport)

- Where we live: The Huntsville/Madison area (we drive these roads every day)

- Community involvement: Donors to the North Alabama Zoological Society, members of the Huntsville/Madison County Chamber of Commerce

We’re invested in this community for the long term.

No Repairs, No Fees, No Showings

No Repairs, No Fees, No Showings

When you sell to a traditional real estate agent, you pay 5-6% in commissions plus closing costs. When you sell to us, you pay nothing. The cash offer we make is what you walk away with.

More Details

What you DON’T have to do:

- Fix anything (we buy as-is)

- Clean or stage the property

- Make repairs or updates

- Host showings with strangers walking through

- Pay agent commissions (typically 5-6% of sale price)

- Pay closing costs (we cover them)

- Deal with buyer inspections or repair requests

- Worry about the deal falling through

What happens:

- You contact us (call, text, or fill out form)

- We schedule a convenient time to see the property (usually within 48 hours)

- We make you a fair cash offer within 24 hours

- You choose the closing date (as fast as 7 days or on your schedule)

- We meet at the title company and you get your check

We Use Huntsville-Based Partners

We Use Huntsville-Based Partners

When we purchase and renovate homes in Huntsville, we work with local professionals that we know and trust. We have built a great team that is able to handle every aspect of buying and renovating Huntsville area homes.

More Details

Title Company: We close most transactions at Conwell Title & Escrow. They know our process and can close quickly when needed.

Foundation Repair: We partner with Deep South Construction Pros for pier and beam work and foundation stabilization.

HVAC: 3M Heating & Air handles our heating and cooling installations.

Inspections: We use licensed Alabama home inspectors familiar with Huntsville properties.

Why this matters to you:

- We can close faster (these partners know us and move quickly)

- We understand actual local repair costs (no inflated estimates in our offers)

- We support local businesses (not national chains)

- We can handle any property issue (established relationships)

Our Track Record in Huntsville

Our Track Record in Huntsville

Since opening in 2021, we’ve purchased 200+ properties in North Alabama, with the majority in the greater Huntsville area. We are invested in our community and revitalizing homes in our area.

More Details

We’ve purchased homes all over North Alabama.

- 50+ homes in northeast Huntsville (Jones Valley, Hampton Cove, Blossomwood area)

- 30+ homes in southeast Huntsville (Monte Sano, Bailey Cove area)

- 20+ downtown/central Huntsville properties (Old Town, Five Points, downtown)

- 40+ in other Huntsville neighborhoods

- 60+ in surrounding areas (Madison, Harvest, Hazel Green, etc.)

Common situations we’ve handled in Huntsville:

- 40+ inherited properties (probate sales through Madison County)

- 25+ homes in pre-foreclosure

- 30+ properties with significant foundation issues

- 20+ fire or water damaged homes

- 15+ hoarder situations requiring complete cleanout

- 20+ rental properties from tired landlords

- 30+ properties with other unique situations

See How Our Cash Offer Process Works

In this short video, Brandon (owner and licensed real estate agent) explains exactly how our cash offer process works in Huntsville—from the moment you contact us to the day you get your check at closing. No banks, no repairs, and no real estate agents taking commission.

How to Sell Your Huntsville House for Cash in 4 Simple Steps

CONTACT US

Call, text, or fill out our form with your Huntsville property address. We’ll ask a few basic questions about the property and your situation.

PROPERTY VISIT

We’ll schedule a convenient time to see your house within 24-48 hours. No need to clean or prepare. The visit typically takes 15-20 minutes.

RECEIVE YOUR CASH OFFER

Within 24 hours, we’ll present a fair cash offer. No pressure to accept—take your time to compare options.

CHOOSE YOUR CLOSING DATE

If you accept, you pick the closing date. Need to close in 7 days? We can do it. Need 60 days to move out? No problem.

“Yellowhammer was the best experience that I have had with a home buyer. Very professional and on time. No loop holes to jump through. The staff was exceptional with their kindness. They were fast to return my calls and always had an answer to my questions. Thank you so very much h for the way you handled this transaction.” -Serena Adams

[Read Serena’s Full Review On Google→]

Serving All of Huntsville & Surrounding Communities

We are your neighbors, and we actively buy houses throughout the entire Huntsville metro area. We’re not limited to certain zip codes or property values. No matter where your property is located, if it’s in Huntsville or anywhere in the Tennessee Valley, we want to make you an offer.

Downtown & Central Huntsville

Zip Codes: 35801, 35805

This is the heart of historic Huntsville, including:

- Old Town / Twickenham Historic District: We love these Victorian and antebellum homes, even when they need significant updates. We’ve purchased several properties in this area with foundation issues, outdated electrical (knob-and-tube wiring), and cast iron plumbing that needed replacement.

- Downtown: Condos, lofts, and mixed-use properties near the Courthouse Square and Von Braun Center

- Five Points: Charming bungalows and cottages, many built in the 1920s-1940s

Recent purchase example: We bought a 1920s craftsman bungalow on Lincoln Street that needed complete electrical rewiring, foundation repair, and HVAC installation.

Northeast Huntsville

Zip Codes: 35801, 35806, 35810, 35811

This area includes some of Huntsville’s most established and growing neighborhoods:

- Blossomwood: Large, elegant homes (many mid-century) on tree-lined streets

- Jones Valley: Mix of mid-century ranches and newer construction

- Lakewood: Near Brahan Spring Park, popular family neighborhood

- Hampton Cove: Master-planned community with golf course, newer homes (1990s-present)

Common issues we handle here:

- HVAC systems reaching end of life (20+ years old)

- Foundation movement due to expansive limestone clay soil

- Outdated kitchens and bathrooms (1970s-1980s originals)

- Large lots needing significant landscaping work

Recent purchase example: We purchased a home on Dewitt Drive in Jones Valley that needed $35,000 in foundation repairs, new HVAC, and kitchen/bath updates.

Southeast Huntsville

Zip Codes: 35802, 35803, 35824

This side of town includes:

- Monte Sano area: Homes on the mountain with stunning views (and unique foundation challenges)

- Goldsmith Schiffman: Close to Huntsville Hospital and downtown

- Bailey Cove / Weatherly: Newer developments with families

What we buy here:

- Older homes needing updates on Monte Sano

- Investment properties near the hospital

- Inherited properties from families relocating

- Foreclosure-threatened homes

Southwest Huntsville & Research Park Area

Zip Codes: 35805, 35806, 35816

This area is adjacent to Redstone Arsenal and Cummings Research Park:

- Research Park: Townhomes, condos, and single-family homes near the tech corridor

- Westlawn: Mix of older and newer properties

- Lakewood / Meadowbrook: Established neighborhoods

Why sellers contact us from this area:

- Job relocations (common with defense contractors and NASA)

- Rental properties that became difficult to manage

- Inherited properties from parents who worked at Redstone

West Huntsville & County Areas

Zip Codes: 35806, 35810, 35816

Includes areas west of town toward Madison County line:

- Providence / West Limestone: Newer subdivisions

- Harvest area: Mix of city and county properties

- Rural properties: Homes on larger lots outside city limits

We buy all property types here:

- Single-family homes

- Mobile homes on land

- Properties on 1+ acres

- Homes that don’t qualify for traditional financing

Considering selling a house in another city in Madison County or other North Alabama cities?

Visit our specific pages for Madison, Decatur, Athens, Florence, and all of our service areas.

We Solve Real Estate Problems in Huntsville

We don’t just buy houses for cash—we solve problems for Huntsville homeowners in difficult situations. For more articles about specific seller situations we can handle go to our Seller Resources page.

Rental Property Headaches?

If you have a rental property in Huntsville that’s costing you more than it’s making, we’ll buy it—even with tenants still in place. No evictions necessary.

Tired of being a landlord? We’ll buy it—tenants and all.

Being a landlord in Huntsville can be exhausting:

- Late or missing rent payments

- Expensive repairs and maintenance

- Difficult tenants

- Property management fees

- Eviction stress

- Time investment

If you own a rental property in Huntsville that’s become more trouble than it’s worth, we can buy it—even with tenants still in place.

We’ve purchased:

- Section 8 rental properties

- Multi-family properties (duplexes, triplexes)

- Single-family rentals with problem tenants

- Properties needing significant deferred maintenance

- Rental properties with tenants on month-to-month leases

Huntsville rental property example: We purchased a duplex near Oakwood University where one side had paying tenants and the other side had been vacant for 6 months due to needed repairs. The owner was tired of the hassle and constant maintenance calls. We bought it as-is, with the tenants in place, and the owner walked away without dealing with eviction or repairs.

Foundation Issues Or House Needs Repairs?

Foundation issues? Roof damage? Outdated electrical? We buy houses in any condition. You don’t have to fix anything.

Huntsville’s limestone soil causes foundation problems.

The expansive clay and limestone soil throughout Huntsville causes foundation movement, leading to:

- Cracks in walls and ceilings

- Doors and windows that won’t close properly

- Sloping floors

- Separation between walls and ceilings

- Visible gaps around window frames

Traditional buyers will run when they see foundation issues. Their lender won’t approve the loan until repairs are made, and those repairs can cost $15,000-$50,000 or more.

We buy houses with foundation problems regularly.

- We have local foundation specialists we work with who give us accurate estimates

- We know exactly what the repairs will cost (not inflated “scare tactic” estimates)

- We factor the repair cost into our offer

- We handle all repairs after closing

Recent Huntsville foundation purchases:

- Rita Lane – Required full foundation stabilization with piers ($42,000 in repairs)

- Dewitt Drive – Foundation movement throughout, doors wouldn’t close ($35,000 in repairs)

- Norris Road – Significant floor slope and wall cracks ($28,000 in repairs)

You don’t need to fix your foundation to sell to us. We’ll make you an offer that accounts for the repairs needed.

Going Through a Divorce?

We can help you liquidate the marital home quickly so both parties can move forward. We handle everything professionally and can work with attorneys from both sides to make the process smooth.

We can help you liquidate the asset quickly.

The family home is often the biggest asset to divide in a divorce. Selling it traditionally can take months—months of continued joint ownership, payments, and stress.

We can:

- Make a fair offer that both parties can agree on

- Close quickly (eliminating ongoing costs and conflict)

- Work with your divorce attorneys

- Provide clear documentation for court proceedings

- Handle the situation with discretion and respect

Huntsville divorce example: We purchased a home in Hampton Cove in 2023 from a couple going through divorce. Neither wanted to keep the house, but it needed approximately $20,000 in repairs (roof, HVAC, and cosmetic updates). Rather than argue about who would pay for repairs or wait months for a traditional sale, we made them a fair cash offer, and they closed in 18 days—splitting the proceeds and moving on with their lives.

Facing Foreclosure in Huntsville?

We can buy your house quickly and help you stop the foreclosure auction at the Madison County Courthouse. We’ve helped dozens of Huntsville homeowners avoid foreclosure and move forward with a fresh start.

We can stop the auction before it’s too late.

We’ve successfully stopped dozens of foreclosures in Huntsville by:

- Making a cash offer within 24-48 hours

- Closing in as little as 7 days (if needed for time-sensitive situations)

- Paying off your mortgage and any back payments/fees

- Giving you any remaining equity

- Saving your credit from a foreclosure record (which stays for 7 years)

Recent Huntsville foreclosure prevention: We purchased a home on Bailey Cove Road in October 2024 where the homeowner owed $178,000 and was 6 months behind on payments (approximately $12,000 in back payments plus fees). The auction was scheduled for November 15th. We closed in 11 days, paid off everything, and the homeowner received $17,000 at closing—all while avoiding a foreclosure on their credit report.

Timeline is critical. The earlier you contact us, the more options we have to help.

Hoarder House or Cluttered Property?

We’ll buy the property in its current condition. You don’t have to clean out anything. We handle all junk removal and cleanup after closing.

We handle cleanouts with discretion and respect.

Hoarder situations are sensitive and overwhelming. Whether it’s your own situation or you’re dealing with a family member’s property, we can help.

What we do:

- Purchase the property as-is (you don’t have to clean anything)

- Handle complete cleanout after closing (at no cost to you)

- Work with professional cleanout services

- Dispose of items properly and legally

- Handle the situation with complete discretion (no judgment)

Huntsville example: We purchased a home in Old Town where the owner had accumulated possessions over 30+ years. Every room was packed floor to ceiling. The owner’s adult children didn’t know where to start. We made a fair offer, handled the complete cleanout after closing, and even helped the family find some personal items they wanted to keep.

Inherited a House in Huntsville?

Navigating probate through the Madison County Probate Court can be complicated. We’re familiar with the local probate process and can often make you a cash offer before probate is fully complete. We can also recommend local probate attorneys if needed.

We handle Madison County probate sales regularly.

When you inherit a house in Huntsville, it can be overwhelming—especially if:

- The house is full of belongings from your loved one

- You live out of state

- The property needs repairs

- There are multiple heirs who can’t agree

- Estate debts need to be paid

We’ve handled 30+ probate properties through Madison County Probate Court and understand:

- The exact documentation required

- How to work with your estate attorney

- Timeline expectations (typically 30-60 days from first contact to closing)

- How to get court approval for the sale

- How to handle cleanout of personal belongings

Huntsville probate example: We purchased a home on Dewitt Drive in Jones Valley from a seller who inherited her mother’s house but lived out of state. The house was full of 40+ years of belongings. We handled the complete cleanout, coordinated with her estate attorney, worked through Madison County Probate Court, and closed in 45 days. The seller didn’t have to make a single trip to Alabama.

Meet Your Local Huntsville Home Buying Team

Yellowhammer Home Buyers is run by Brandon Hardiman and David Barnett—two local professionals who live in the Huntsville/Madison area near you. We’re not a national franchise, a lead-generation website, or a call center in another state. When you call us, you talk directly to the owners. When we come to see your property, it’s Brandon or David who shows up. And when you close, we’re at the table with you.

Brandon Hardiman – Owner & Licensed Agent

Before real estate, I spent over 10 years working as an engineer—and that problem-solving mindset still drives everything I do today.

For the past 5+ years, I’ve helped homeowners in Huntsville and North Alabama sell properties in all kinds of situations, especially when the house needs repairs or life circumstances make a traditional sale difficult.

I’m also a licensed real estate agent, which gives me the ability to offer more insight and options than many investors. Whether it’s a straightforward cash purchase, listing your property traditionally, or a creative hybrid solution—I can help you find the best path forward.

I grew up in North Alabama and know these Huntsville neighborhoods personally. I’ve purchased homes in Jones Valley, Hampton Cove, Five Points, Old Town, and throughout the area. I understand the local market, common property issues (like our limestone soil foundation problems), and the processes involved (like Madison County probate sales).

Whether it’s a straightforward cash offer or a more creative solution, my goal is always the same: make the process simple, clear, and respectful, while helping you move forward with confidence.

Alabama Real Estate License: #000170383-1

License Disclosure: Brandon Hardiman is a licensed real estate agent in Alabama, license number 000170383-1, brokered by Elevate RE LLC – 000172973-0, 606 Rison Ave NE, Huntsville, AL 35801.

David Barnett – Owner & Licensed Broker

I’m a U.S. Army Veteran and a licensed real estate broker, and I’ve been helping people buy and sell real estate since earning my license in 2014. Over the years, I’ve completed 400+ transactions, giving me the experience to guide clients through almost any situation.

In 2017, I completed my first fix-and-flip renovation on my own, and that’s when I found my passion for the construction side of real estate. I enjoy taking distressed properties—especially here in Huntsville—and turning them into something beautiful. I’m skilled at managing renovations, working with contractors, and making sure projects get finished the right way.

At Yellowhammer Home Buyers, I focus heavily on the renovation and construction side. When we purchase a property with foundation issues, outdated electrical, or extensive damage, I’m the one evaluating what needs to be done and managing the work.

I know Huntsville properties inside and out—from Victorian homes in Old Town that need complete electrical rewiring, to mid-century ranches in Jones Valley with foundation movement, to newer homes in Hampton Cove that just need cosmetic updates.

My military background taught me discipline, attention to detail, and the importance of following through on commitments. When I tell a homeowner we’ll close on a certain date, we close on that date. When I provide an offer, it’s based on accurate estimates—not inflated numbers designed to renegotiate later.

Alabama Real Estate Broker License: #000110591-1

License Disclosure: David Barnett is a licensed real estate broker in Alabama, license number 000110591-1, brokered by Elevate RE LLC – 000172973-0, 606 Rison Ave NE, Huntsville, AL 35801.

Understanding Your Cash Offer: Complete Transparency

We believe in complete honesty and transparency. Every deal is different and our cash offer depends on a variety of factors. Unlike many cash home buyers who won’t explain how they arrived at their offer, we’ll show you how we come up with our offers and pay cash for homes.

[Your Offer] = [ARV] – [Repair Cost] – [Selling Cost] – [Our Profit]

Here’s What Each Part Of The Equation Means:

ARV (After Repair Value)

What your house would be worth fully renovated and sold on the retail market in Huntsville. We determine this by looking at comparable homes in your neighborhood that have recently sold.

More Details

How we determine ARV:

- Recent comparable sales in your Huntsville neighborhood

- Square footage, bedrooms, bathrooms, and lot size

- Location and school district

- Market conditions (current supply and demand)

Example (Jones Valley home): Your 1,500 sq ft house on Dewitt Drive has major foundation issues and needs some other repairs. In perfect condition with new HVAC, updated kitchen/bathrooms, and all repairs complete, would sell for approximately $230,000 based on recent sales of similar updated homes in your neighborhood.

Repair Cost

The actual cost to bring your home to retail condition. This includes materials, labor, permits, and our time managing the renovation. For Huntsville homes, this often includes HVAC, plumbing/electrical (especially for historical homes), roof, foundation, and all the cosmetic work to make it beautiful.

More Details

Common Huntsville repairs:

- Foundation repair: $15,000 – $50,000 (depending on severity)

- New HVAC system: $6,000 – $12,000

- Roof replacement: $8,000 – $15,000

- Kitchen remodel: $15,000 – $30,000

- Bathroom updates: $5,000 – $12,000 per bathroom

- Flooring throughout: $8,000 – $15,000

- Electrical updates: $3,000 – $15,000 (depending on scope)

- Plumbing repairs: $2,000 – $10,000

- Paint interior/exterior: $4,000 – $8,000

- Landscaping: $2,000 – $5,000

Example (same Jones Valley home):

- Foundation repair: $24,000

- New HVAC: $8,500

- Kitchen update: $16,000

- Bathroom updates: $12,000

- Flooring: $9,000

- Paint & misc: $6,000

- Total Repair Cost: $75,500

We get actual contractor estimates—not inflated guesses.

Selling Cost

Typically around 10% of ARV. This includes real estate agent commissions (when we resell), closing costs for when we buy it from you and when we sell it, and holding costs (utilities, insurance, taxes while we own it).

More Details

Typical selling costs:

- Real estate agent commission: 5-6% of sale price

- Closing costs: 1-2% of sale price

- Holding costs (mortgage, insurance, taxes, utilities): $500-$1,000/month

- Renovation time: 2-6 months typically

Example calculation:

- Agent commission (6% of $230,000): $13,800

- Closing costs when we buy (1.5% of $230,000): $3,450

- Closing costs when we sell (buyer usually pays some): $2,550

- Holding costs (4 months @ $800/month): $3,200

- Total Selling Cost: $23,000

This is what we’ll pay when we sell your home after renovating it.

Our Profit

Generally 20% of ARV for houses in decent condition, or at least 75% of repair costs for houses needing extensive work. The more repairs needed, the more risk we take on, so we need a larger profit margin to justify that risk.

More Details

Our profit formula: We typically aim for 20% of ARV OR 75% of repair costs, whichever is GREATER. This means:

- On a lower-repair project, we aim for 20% of ARV

- On a high-repair project, we need at least 75% of the repair cost to compensate for the additional risk and complexity

Example (same Jones Valley home):

- 20% of ARV: 20% × $230,000 = $46,000

- 75% of repairs: 75% × $88,500 = $66,375

- Our profit target: $66,375 (the greater of the two)

Why the higher profit on high-repair projects? Because:

- More risk of hidden issues being discovered

- Longer timeline (more holding costs)

- More contractor coordination required

- More things that can go wrong

- Higher capital investment with longer return period

This compensates us for:

- Risk (property might have hidden issues)

- Time (3-6 months from purchase to resale)

- Capital invested (we’re paying cash upfront)

- Expertise (managing renovation, contractors, resale)

Putting It All Together

Once we have all of this information, we can now calculate what our potential cash offer could be.

Cash Offer Example

Dewitt Drive Example:

- ARV (retail value after repairs): $230,000

- Repair Costs: -$75,500

- Selling Costs: -$23,000

- Our Profit: We calculate both:

- 20% of ARV = $46,000

- 75% of repairs = $66,375

- We use the greater: -$56,625

- = YOUR CASH OFFER: $74,875

(We’d likely round this to $75,000 for simplicity)

Want A Real Cash Offer (not an estimate)?

The calculator gives you a ballpark, but every house is unique. The only way to get an accurate offer is to let us see the property in person. Fill out the form below or call us at (256) 795-3014 to get your official cash offer.

"*" indicates required fields

Recent Houses We've Purchased in Huntsville

Since 2021, we've purchased over 200 properties in North Alabama, with the majority right here in Huntsville. These aren't generic claims—these are real transactions with real homeowners who needed our help.

927 Dewitt Dr SE Huntsville, Al 35802

The Situation:

Karen lived out of state and needed to get her mom moved to an assisted living home close by. They had been waiting for a spot to open up, and when one finally did, they had to pay to lock it in. They could only afford to do so by getting the equity out of her mother's home.

The Challenge:

- The home was well taken care of but older and dated, needing some work

- Karen didn't have the ability to manage the work from a distance

- They couldn't wait for it to sell on the traditional market

- They needed the money quickly to secure the assisted living spot

Our Solution:

We made them a cash offer that allowed her mother to move on to her next stage of life and closed within 2 weeks so they could put the money down for her mom's place in the assisted living home.

The Result:

Karen's mother was able to move to assisted living, and the house was sold quickly without Karen having to manage repairs from out of state.

Client Review: "The team at Yellowhammer - Brandon, David, Ronnie and the incredible Tedi - made the very stressful and emotional process of quickly selling my parent's home smoother and easier than I ever imagined. They have integrity, were very accommodating, and completely honest from my first phone call to them through and even after the closing. I never had a moments doubt that I had chosen the right group. I highly recommend their services." - Karen Isola

[Read Karen's Full Review On Google→]

2100 Woodmore Dr Huntsville, Al 35803

The Situation:

Jesse, her husband, and her mother needed a larger home. They purchased a new home with intentions to sell their current home but realized it needed too much work they didn't have the money or time to put into it.

The Challenge:

- The house needed too much work to sell traditionally

- They didn't have the money or time to make the repairs

- They couldn't afford to keep making two mortgage payments

Our Solution:

They called us and we came up with a cash offer that worked for them. We bought the house as-is, so they didn't have to make any repairs.

The Result:

We put the cash in their pocket in less than 2 weeks, allowing them to move forward with their new home without the burden of two mortgage payments.

"Very professional and priced the house fairly. I would recommend yellow hammer flips to anyone that needs their service. Word of mouth with high praises is how we found YH to begin with." - Jesse Wheat

3314 Lockwood Ct SW, Huntsville, Al 35805

The Situation:

A tree fell on Alan's house, causing significant damage.

The Challenge:

- The property had major damage from the fallen tree

- Electrical updates were needed

- Alan needed a straightforward solution without dealing with repairs

Our Solution:

We purchased the home as-is with a cash offer. We even helped line up a junk removal crew for the leftover items.

The Result:

We closed in 7 days, allowing Alan to move on quickly without having to deal with repairs or cleanup.

108 Crown Oak Ln, Huntsville, AL 35806

The Situation:

Randy inherited this property in Hampton Cove and didn't want the burden that came with it. The house needed kitchen and bathroom updates and he didn't want to manage contractors or deal with months of cleanup from out of state.

The Challenge:

Inherited properties can be emotionally difficult and logistically challenging, especially from a distance. The house needed significant updates to sell traditionally.

Our Solution:

We purchased the home as-is with a cash offer. Randy didn't have to fix anything or even clean it out. We closed in 3 weeks.

Result:

We arranged a mobile notary so signing was easy and flexible. Randy was able to settle the estate without ever having to come back to Huntsville.

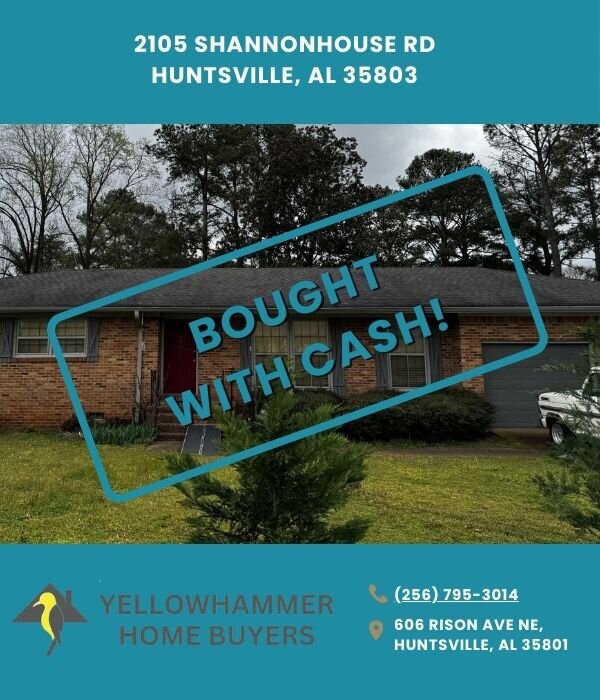

2105 Shannonhouse Rd, Huntsville, AL 35803

The Situation:

Marcus was relocating to another city and needed money to cover his moving expenses.

The Challenge:

- The property needed a roof replacement

- Marcus needed a straightforward solution without complications

- He couldn't afford to make repairs before selling

Our Solution:

We stepped in as a cash buyer so there were no repairs, no showings, and no agents involved. We covered closing costs and made sure there were no surprise fees.

The Result:

We closed in 21 days. Marcus received the cash he needed for his relocation without having to replace the roof or deal with the traditional selling process.

2206 Norris Rd, Huntsville, AL 35810

The Situation:

Angela contacted us when her home was headed toward foreclosure. She was behind on payments and the property also needed plumbing repairs she couldn't afford.

The Challenge:

- Time was running out before the foreclosure auction at the Madison County Courthouse

- Angela needed to sell fast to save her credit and avoid foreclosure on her record

- The property needed plumbing repairs she couldn't afford to make

Our Solution:

We handled everything from paperwork to closing so it stayed stress-free. We purchased the home as-is with a cash offer.

The Result:

We closed in less than 30 days, helping Angela avoid the foreclosure and move forward with a fresh start. We even helped line up a junk removal crew for leftover items, making the move-out process easier for Angela.

More Recent Huntsville Deals:

- 7804 Hilton Dr (35802) - Inherited property, broken windows and exterior repairs - Closed in 30 days

- 2109 Francis St (35811) - Inherited property, flooring throughout needed - Closed in 7 days

- 4319 Baywood Dr (35805) - Tired landlord, plumbing repairs needed - Closed in 30 days

- 111 Wilkenson Dr (35811) - Foreclosure, broken windows - Closed in 18 days

- 903 Fagan Springs Dr SE (35801) - Inherited, exterior repairs - Closed in 12 days

- 8602 Hickory Hill Ln (35802) - Inherited, electrical updates - Closed in 3 weeks

- 174 Wilkenson Dr NE (35811) - Foreclosure, roof replacement - Closed in 30 days

- 107 Moonglow Trl (35806) - Inherited, HVAC replacement - Closed in 18 days

Traditional Sale vs. Selling to Yellowhammer in Huntsville

We believe in helping you make an informed decision—even if that means you choose a different option than selling to us. Here's an honest comparison of your main options for selling your Huntsville house:

| Traditional Agent Listing | FSBO (For Sale By Owner) | iBuyer (Opendoor, etc.) | Cash Buyer (Yellowhammer) | |

| Timeline to Close | 45-90 days (Huntsville average) | 60-120 days | 14-60 days | 7-30 days |

| Upfront Costs | $3,000-$8,000 (repairs, staging, photos) | $2,000-$10,000+ (repairs, marketing) | $0 | $0 |

| Repairs Needed | Buyers will request repairs after inspection | Buyers expect move-in ready | Must meet their criteria (built after 1960, certain condition standards) | None - we buy as-is in any condition |

| Closing Certainty | 30-40% of deals fall through | High risk of falling through | Moderate - they can cancel if inspection fails | 95%+ certainty once offer accepted |

| Fees & Commissions | 5-6% agent commission + 1-2% closing costs = 6-8% total | 0% commission but 2-3% closing costs | 5-12% service fee (varies by market) | $0 fees, $0 commissions |

| Showings Required | Yes - multiple showings, open houses, disruption | Yes - you handle all showings yourself | Minimal - usually just one inspection | One visit - that's it |

| Convenience Level | Medium - agent handles marketing but you deal with showings, repairs, inspections | Low - you do everything yourself | High - mostly online/automated | High - we handle everything |

| Who Handles Repairs | You pay for repairs upfront | You pay for repairs upfront | You must meet their standards or they won't buy | We handle all repairs after purchase |

| Best For... | Houses in perfect condition, not in a hurry, want maximum market value | People with real estate experience, time to invest, perfect condition homes | Homes built after 1960 in certain value ranges, standard suburban houses | Any condition, any situation, need to close fast, can't afford repairs |

| Price Expectation | 95-100% of market value (if perfect condition) | 95-100% of market value (if you find the right buyer) | 85-93% of market value minus their fee | 70-85% of ARV (accounts for repairs and risk) |

| Typical Huntsville Scenario | List at $250k, sell for $245k, pay $15k in commissions/costs, NET $230k | List at $250k, take months to sell, pay $6k in costs, NET $244k | $250k house, they offer $220k minus 7% fee ($15k), NET $205k | $250k house needing $50k repairs, our offer $155k, NET $155k same-day cash |

| Risk Factors | Deal can fall through (inspections, financing, appraisal), months on market with no guarantee | Must handle all legal compliance, risk of being sued, no marketing reach | They can cancel based on inspection, only buy certain properties | Minimal - we close as promised |

| Local Support | Local agent with market knowledge | No professional support | National company, no local presence | Local owners, in-person support |

Which Option Is Right For You?

Choose Traditional Agent Listing if:

- ✓ Your Huntsville home is in excellent condition (move-in ready)

- ✓ You're not in a hurry—can wait 2-4 months for the right buyer

- ✓ You want maximum market value and don't mind paying 6-8% in fees

- ✓ You're willing to handle showings, inspections, and potential buyer requests

- ✓ You can afford to make any repairs buyers request

If you think listing with an agent is the best choice for you, we've got good news! We can list it for you! Unlike most other home buyers, we can give you options. If a cash offer and fast closing doesn't work for you, we can list it on the MLS to help you get the most profit for your home!

Choose FSBO (For Sale By Owner) if:

- ✓ You have real estate experience or are willing to learn

- ✓ Your home is in perfect condition

- ✓ You have time to handle showings, negotiations, paperwork

- ✓ You have money to invest in marketing and any required repairs

- ✓ You're comfortable handling contracts and legal requirements

Choose iBuyer (Opendoor, Offerpad, etc.) if:

- ✓ Your home was built after 1960

- ✓ Your home is in a standard subdivision (they avoid unique properties)

- ✓ Your home is in relatively good condition

- ✓ You want some convenience but are willing to pay 5-12% in fees

- ✓ You're okay with an online/automated process (no local support)

- ✓ Your home falls within their value range (they often won't buy very low or very high priced homes)

Choose Local Cash Buyer (Yellowhammer) if:

- ✓ Your Huntsville home needs significant repairs (foundation, HVAC, roof, etc.)

- ✓ You're facing foreclosure, probate, or time-sensitive situation

- ✓ You don't have money to invest in repairs upfront

- ✓ You don't want to deal with showings or strangers walking through

- ✓ You want certainty (no risk of deal falling through)

- ✓ You value local support and personal service

- ✓ You need to close quickly (days or weeks, not months)

- ✓ You want zero fees and zero hassle

Not Sure Which Option Is Best?

We're happy to discuss your situation honestly—even if selling to us isn't the best choice for you. Sometimes listing with an agent IS the better option, and we'll tell you if that's the case.

Get My Cash Offer Now!

"*" indicates required fields

Huntsville Real Estate Market Intelligence

We're not just buying houses in Huntsville—we're active participants in the local market every single day. Here's what we're seeing currently.

Current Market Conditions

Huntsville Market Overview: Based on our active buying and close monitoring of the Huntsville MLS, here's the current state of the market:

- Average Days on Market (As-Is Properties): ~80-100 days

- Percentage of Listings with Price Reductions: 38-42%

- Percentage of Deals Falling Through: 25-30% (typically due to inspection issues, financing problems, or appraisal gaps)

- Homes sitting over 90 days: Usually need repairs or are priced above market

What This Means for Sellers: If your Huntsville home needs repairs, a traditional listing might sit on the market for 3-4 months before you get an offer—and that offer will likely come with repair contingencies or requests for significant price reductions after inspection.

Our average timeline: From first contact to closing = 21 days

Common Repair Issues Affecting Huntsville Sales

HVAC Systems: Many Huntsville homes have HVAC systems that are 15-25 years old (at or past end of life). Replacement costs $6,000-$12,000, and buyers will either request this be fixed or deduct it from their offer.

Roofs: Alabama weather (heat, storms, hail) is hard on roofs. A roof with 3-5 years of life left might get you through an inspection, but anything less and buyers will request replacement ($8,000-$15,000).

Outdated Electrical: Especially in older Huntsville neighborhoods (Old Town, Five Points, Twickenham), we see homes with outdated electrical—knob-and-tube wiring, 60-amp service, aluminum wiring. Modern buyers expect 200-amp service and updated wiring throughout.

Neighborhood-Specific Observations

Downtown / Old Town / Twickenham: These historic homes have incredible character but often need significant systems updates. We've purchased several in this area with:

- Complete electrical rewiring needed: $8,000-$15,000

- Plumbing replacement (cast iron pipes): $10,000-$20,000

- No central HVAC: $12,000-$18,000 to install

- Foundation issues: $15,000-$40,000

The charm is there, but the costs are real. We love these homes and have the expertise to renovate them properly while preserving historic character.

Jones Valley / Blossomwood / Lakewood: Many mid-century homes (1950s-1970s) in these established neighborhoods are reaching the age where major systems need replacement. We frequently see:

- HVAC original to the home (20-30+ years old)

- Galvanized plumbing needing replacement

- Single-pane windows and poor insulation

- Foundation movement from settling over decades

- Outdated kitchens and bathrooms

These homes are in great locations with large lots—they just need investment in updates.

Hampton Cove: Newer construction (1990s-present) but we've purchased several here with:

- Foundation issues (still have expansive soil)

- Builder-grade materials wearing out

- HOA-related sales complications

Monte Sano: Properties on the mountain have unique challenges:

- Foundation issues due to hillside settling

- More complex repairs due to elevation and access

- Septic systems (not city sewer)

- Well water (not city water) in some areas

We have experience with these unique mountain properties.

Government & Community Resources

Madison County Resources:

City of Huntsville:

Frequently Asked Questions About Selling Your House in Huntsville

Do you really buy houses in any condition in Huntsville?

A: Yes. We buy houses in Huntsville regardless of condition. Whether your home needs foundation work (common here due to our limestone soil), a new roof, HVAC replacement, electrical updates, or complete renovation—we'll buy it as-is. We've purchased everything from beautiful updated homes to properties that needed to be gutted. You don't have to fix, clean, or repair anything.

How fast can you close on a house in Huntsville?

A: We can close as fast as 7 days if you need speed (we've done it many times to help sellers stop foreclosure). However, we can also work on your timeline—if you need 30, 60, or even 90 days to move out, we can accommodate that. You choose the closing date that works best for your situation.

Do I have to pay any fees or commissions when I sell to you?

A: No. Unlike selling with a traditional Huntsville real estate agent where you'd pay 5-6% in commissions plus 2-3% in closing costs, when you sell to Yellowhammer Home Buyers, you pay ZERO fees. No commissions, no closing costs, no repairs, no inspections, no appraisal fees. The cash offer we make is the amount you receive at closing.

My house in Huntsville has foundation problems. Will you still buy it?

A: Absolutely. Foundation issues are common in Huntsville due to our area's limestone bedrock and clay soil. We're very familiar with these issues and factor the foundation repair costs into our cash offer. You don't have to fix the foundation—we handle all of that after we purchase the property. We've bought dozens of Huntsville homes with foundation problems.

I inherited a house in Huntsville that's going through probate. Can you still buy it?

A: Yes. We're very familiar with the Madison County Probate Court process. In many cases, we can make you a cash offer even before probate is fully complete. We've worked with numerous families navigating probate in Huntsville, and we can recommend local probate attorneys if you need one. Learn more about selling inherited property.

I'm facing foreclosure in Huntsville. Can you help?

A: Yes, we've helped many Huntsville homeowners stop foreclosure by purchasing their home before the auction at the Madison County Courthouse. If you accept our cash offer, we can usually close in 7-10 days—often fast enough to pay off the bank and stop the foreclosure. This helps you avoid foreclosure on your record and the damage it does to your credit. Learn more about stopping foreclosure.

What areas of Huntsville do you buy houses in?

A: We buy houses anywhere in Huntsville and the surrounding areas—all zip codes (35801, 35802, 35803, 35805, 35806, 35810, 35811, 35816, 35824, and more). From downtown Huntsville and Twickenham to Hampton Cove and Madison Pike, from Jones Valley to Research Park—we're interested. We also buy in Madison, Athens, Decatur, Florence, and throughout Madison County.

How do you determine your cash offer price?

A: We use the formula: Your Cash Offer = ARV - Repair Costs - Selling Costs - Our Profit. We determine the After Repair Value (ARV) by looking at comparable homes in your Huntsville neighborhood that have recently sold. We calculate repair costs based on the actual work needed. We factor in selling costs (agent fees when we resell, closing costs, holding costs) and our profit margin. Try our cash offer calculator above to see an estimate, or Contact Us for a personalized offer on your specific property.

Do I have to come to your office to close?

A: No. We can close at any title company in Huntsville that's convenient for you. We often use local title companies near where you live to make it easy. We can also arrange for a mobile notary to come to you if that's more comfortable. We're flexible and work around your schedule.

What if I'm a landlord with a rental property in Huntsville that has tenants?

A: We can buy your rental property even with tenants in place. You don't have to evict anyone or wait for leases to expire. If you're tired of dealing with tenant issues, maintenance calls, or the property is costing you more than it's making, we can take it off your hands quickly. Learn more about selling rental properties.

Are you licensed real estate professionals?

A: Yes. Brandon Hardiman is a licensed real estate agent in Alabama (License #000170383-1) and David Barnett is a licensed real estate broker (License #000110591-1). Both are brokered by Elevate RE LLC. This sets us apart from many "we buy houses" companies—we have the licenses, experience, and knowledge to guide you through all your options, not just a cash sale.